Auto Insurance Policies in Las Vegas NV

Liability Insurance Criteria in Las Vegas

Car insurance is a compulsory requirement for every motorist in Las Vegas, Nevada. The condition law requires every vehicle owner to have a legitimate insurance policy that covers bodily injury and property damage liability auto insurance companies in the event of an accident. Liability insurance helps guard the vehicle driver, their passengers, and every other person or vehicle associated with the accident. Opting for the right insurance coverage for your vehicle is an important selection, as it guarantees financial protection in scenario of unpredicted occasions when traveling. Failing to follow the insurance requirement can easily cause charges, greats, or perhaps revocation of driving benefits.

When obtaining car insurance in Las Vegas, motorists possess the option to decide on in between minimal liability coverage or added comprehensive coverage. Minimum required liability coverage delivers general protection versus bodily injury and also home damage triggered by the covered by insurance vehicle driver in an at-fault accident. However, comprehensive coverage offers a wider stable of protection, consisting of insurance coverage for damage resulted in through aspects like fraud, vandalism, or even natural calamities. It is important for car drivers to thoroughly evaluate their insurance policy as well as know the insurance coverage delivered through their insurer to guarantee they are actually appropriately secured while driving in the busy city of Las Vegas.

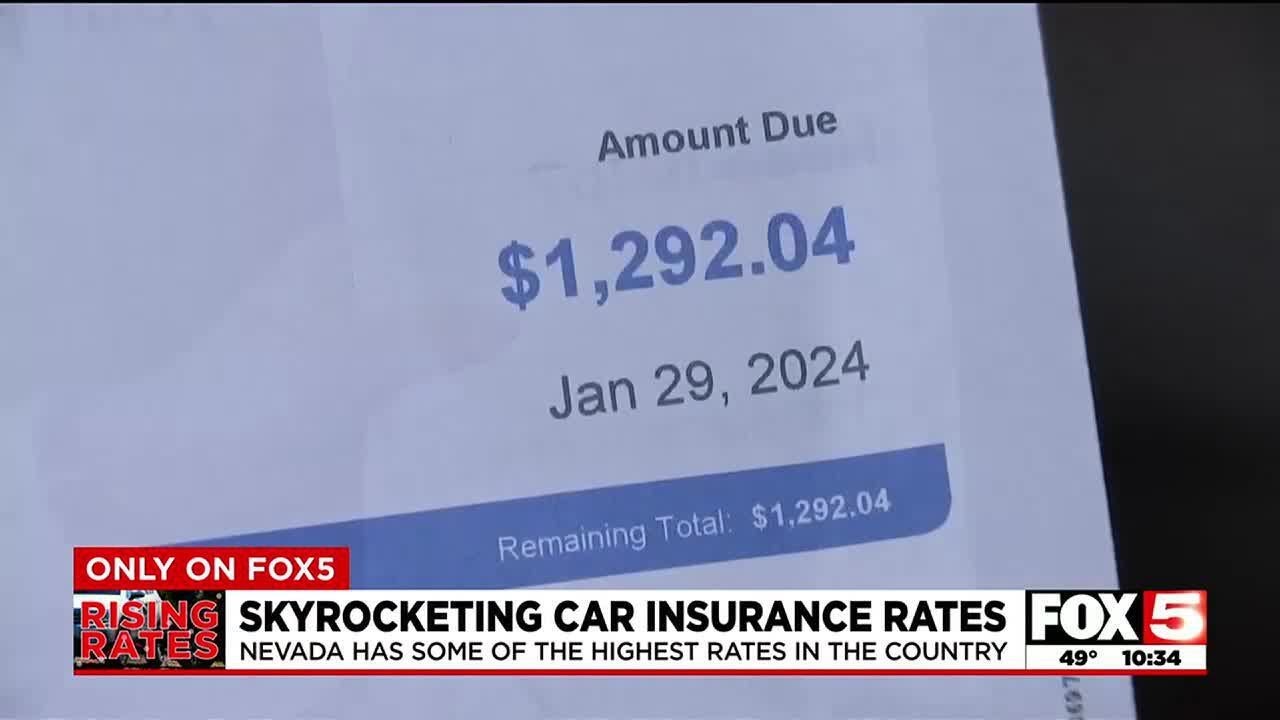

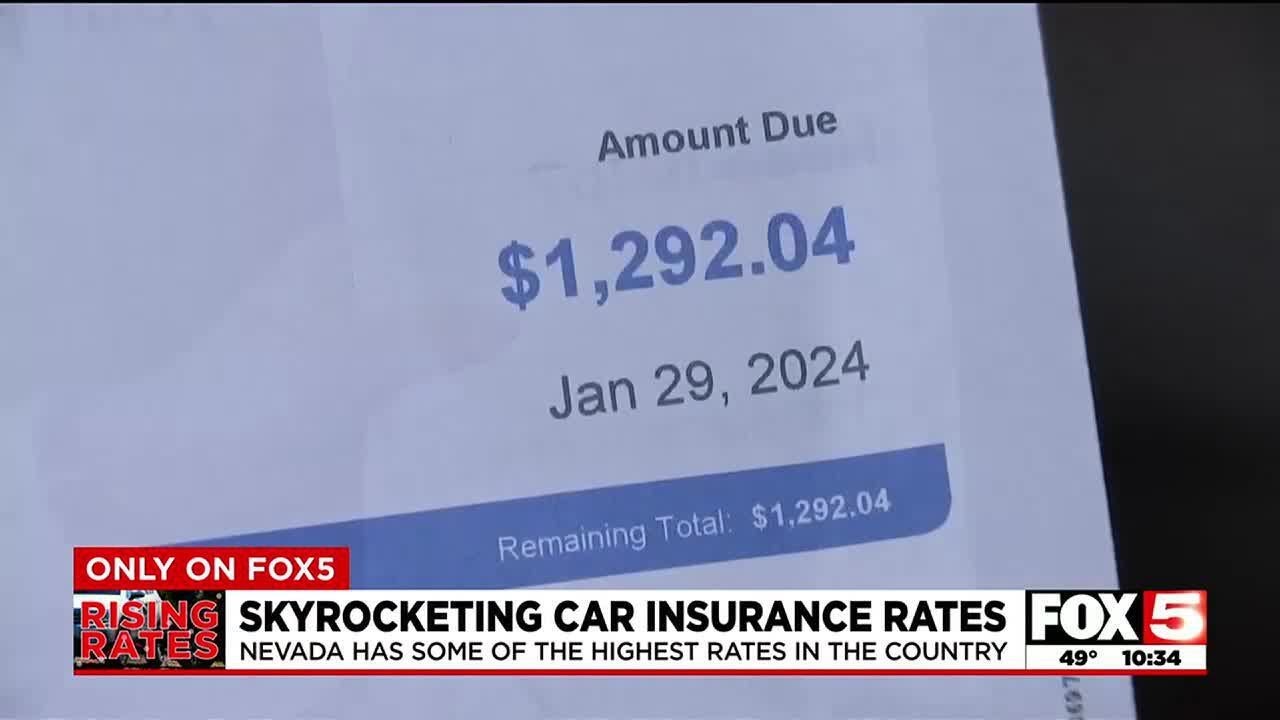

The amount of does car insurance cost in Las Vegas?

Car insurance expenses in Las Vegas can easily differ depending on a number of variables. Auto insurer in the place take into consideration a series of variables when identifying prices for motorists. These can easily feature driving record, coverage limits, bodily injury liability, property damage liability coverage, and also coverage options like extensive and collision protection. The average cost of car insurance in Las Vegas is actually greater than the national average, which could be credited to the one-of-a-kind web traffic shapes and also driving practices in the city.

For teen drivers, the price of car insurance may be considerably higher due to their lack of adventure when driving. In Las Vegas, insurance rates for teen vehicle drivers are actually impacted by aspects such as the sort of vehicle they steer, their driving record, and also the volume of coverage on their auto policy. It is actually highly recommended for moms and dads to look into various choices to find affordable car insurance for their teen drivers, including packing insurance coverage or mounting a telematics device to likely lower insurance rates. Firms like Geico use quotes that consider numerous aspects to give personalized protection for drivers in Las Vegas.

Las Vegas auto insurance discounts

In Las Vegas, auto insurance discounts can assist car drivers conserve cash on their insurance premiums. Numerous insurance provider provide discount rates for numerous reasons like having an excellent driving record, being actually a student along with really good qualities, or even bundling numerous insurance coverage with each other. Through benefiting from these discounts, drivers can easily lower their auto insurance rates as well as discover cheap car insurance that suits their spending plan.

Yet another means to likely reduce your auto insurance rate in Las Vegas is actually by sustaining continuous insurance coverage. Insurance providers commonly give rebates to vehicle drivers who have a record of dependable auto insurance coverage without any kind of lapses. Through revealing proof of insurance and also showing accountable behavior behind the wheel, motorists may get lower insurance costs. Additionally, some insurance business may use unique rebates for sure teams, including female vehicle drivers or even students, so it is actually worth consulting your insurance agent to view if you qualify for any type of extra cost savings on your monthly premium.

Typical car insurance in Las Vegas by rating factor

One key aspect that influences the ordinary car insurance rates in Las Vegas is actually the type of vehicle being actually covered. Insurance providers take into account the make, style, and also age of the vehicle when determining fees. For case, insuring a deluxe cars will commonly include greater premiums reviewed to a standard car. The degree of protection selected likewise influences the cost, with comprehensive coverage being actually extra costly than basic liability coverage.

An additional crucial component that determines typical car insurance rates in Las Vegas is actually the driving record of the policyholder. Responsible motorists along with clean driving files are often qualified for safe car driver discounts, which can easily cause reduced superiors. On the contrary, individuals along with a record of mishaps or visitor traffic transgressions might deal with higher fees because of being perceived as higher danger by insurance business. Additionally, grow older may also play a substantial function in insurance rates, as 20-year-old motorists are commonly thought about riskier to insure compared to a 35-year-old driver. Insurers bear in mind a variety of aspects like the rates of accidents entailing younger vehicle drivers, conformity with teen driving laws, as well as overall driving practices when determining fees.

Why is actually car insurance in Las Vegas thus costly?

Car insurance in Las Vegas is actually particularly costly as a result of a variety of adding elements. One substantial component is actually the eligibility requirements prepared by auto insurers, which can easily influence the expense of insurance coverage. In Nevada, minimum coverage requirements contrast around cities like Boulder City, Carson City, and Las Vegas, with major cities typically imposing greater specifications. Additionally, elements like financial strength ratings and ranking elements can easily influence costs. It is actually essential for vehicle drivers to take into consideration factors such as bodily injury liability, uninsured motorist coverage, and also underinsured motorist coverage when analyzing coverage levels, as these aspects can considerably impact the overall cost of insurance.

In addition, the inclusion of extra attributes like anti-theft tools as well as seeking savings, including those for full time pupils, can likewise determine the price of insurance in Las Vegas Executing digital policy management tools as well as exploring choices for student rebates can deliver financial protection while likely decreasing costs. Auto insurers in Las Vegas often base sample rates on a variety of elements, consisting of coverage levels and also personal instances. By watching regarding complying with minimal needs as well as checking out offered discount rates, drivers in Las Vegas may seek ways to create car insurance extra affordable without risking essential protection.

Bundling insurance coverage in Las Vegas

When it comes to bundling insurance coverage in Las Vegas, policyholders can easily unlock various discount opportunities by combining multiple insurance items under one provider. This strategy certainly not only streamlines the insurance method yet likewise typically causes cost savings. In Las Vegas, insurer normally deliver rebates for bundling vehicle as well as home insurance, making it possible for people to take advantage of affordable rates while ensuring comprehensive coverage all over numerous components of their lifestyle.

Along with lesser annual fees, packing insurance plans in Las Vegas can also streamline managerial jobs through consolidating all policies into one effortlessly accessible electronic format. Whether it is actually managing a small fender bender or reviewing coverage options, having all insurance information in one location could be hassle-free and also dependable. In addition, packing can easily aid prevent a lapse in coverage, guaranteeing people have continuous protection throughout various insurance kinds such as bodily injury coverage, medical payments coverage, and additional coverages at the lowest rate feasible.

What are the liability insurance requirements in Las Vegas?

In Las Vegas, car drivers are actually demanded to possess liability insurance coverage of a minimum of $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $20,000 for property damage.

How a lot performs car insurance cost in Las Vegas?

The price of car insurance in Las Vegas may differ relying on variables like your driving record, age, the form of vehicle you steer, as well as the insurance company you opt for. On average, motorists in Las Vegas pay for around $1,400 each year for car insurance.

What are actually some auto insurance discounts available in Las Vegas?

Some common auto insurance discounts on call in Las Vegas feature multi-policy price cuts for packing a number of insurance plans, safe vehicle driver discounts, and price cuts for having actually anti-theft tools put up in your car.

What is actually the typical car insurance in Las Vegas by rating factor?

The normal car insurance in Las Vegas may vary through rating factor, however variables like grow older, driving record, and also form of car steered may all influence the expense of insurance.

Why is actually car insurance in Las Vegas thus pricey?

Car insurance in Las Vegas may be a lot more costly than in other places as a result of variables such as a higher cost of crashes, theft, as well as vandalism in the city, and also the expense of lifestyle and insurance guidelines in Nevada.

Exactly how can packing insurance plans in Las Vegas assist in saving money?

Packing insurance coverage in Las Vegas, such as mixing your auto and also home insurance with the very same supplier, can easily typically lead to savings coming from the insurance company, ultimately assisting you spare money on your total insurance prices.